02

дек

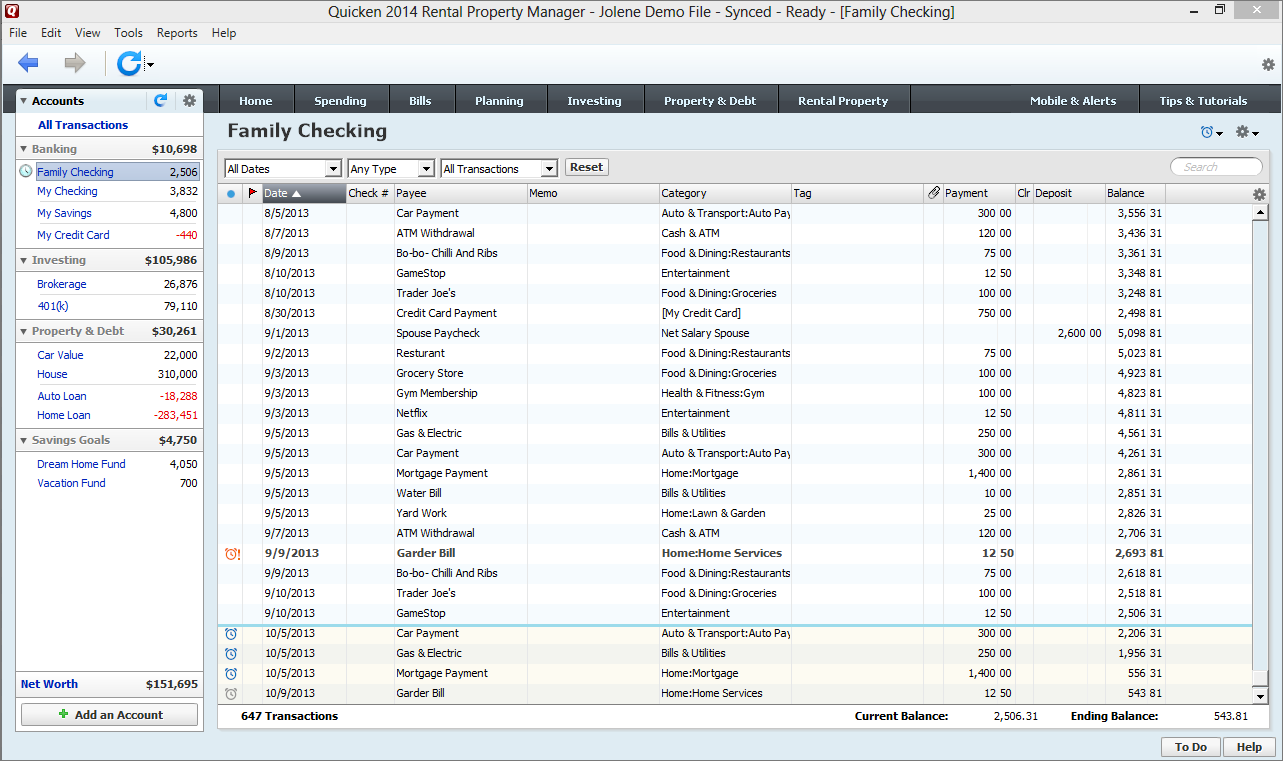

Quicken For Mac 2014

Posted:admin

If you're looking to replace, you're in the right place. For years, Quicken was the name in personal finance software. But let's accept reality – Quicken is often broken. It doesn't sync your accounts problem, you have password problems, screens that should appear are blank, and it's just not a great experience.

One of the biggest news items in the personal finance software space for 2015 was the releasing a new version of Quicken for Mac. The last time there was a true update for Quicken for Mac was in 2007. Quicken Essentials for Mac was released after that, but no one really takes that app seriously. (if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G.

Sometimes it feels like they're just getting you to buy the newer version, right? Quicken was once the most popular and powerful personal finance management software out there. But Quicken isn't what it used to be. It's hard to innovate a platform built in 1983. Back then, cell phones were bricks (if you could afford one) and apps were what you ordered at a restaurant. Quicken has faced a lot of technical issues and its support is meh at best.

(if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G. Look: If you're tired of Quicken, its support and sync issues, and want a suitable free alternative or replacement – we have some options. Here are some of the best Quicken alternatives available: Our Best Picks. If you're quitting Quicken and want to move to a spreadsheet you can customize to exactly what you need, Tiller will automate all the data collection for you.

You build a spreadsheet (or use a template) and Tiller will pull the data for you. Thus, saving you a ton of time and hassle. 11 Best Quicken Alternatives: • – free financial dashboard and wealth planner • – spreadsheet automation to bring it in house • – best in class budgeting tool & mindset • – ad-supported budgeting tool • – compare your situation with your peers • – can import data from Quicken • – not cloud-based • – follows Dave Ramsey's Baby Steps • – follows envelope budgeting method • – open-source and free • – date & calendar based budgeting 1. If you're a long time user of Quicken, you're beyond the “help me build my budget” phase. If you're more interested how your investment account is performing and less interested in just knowing how much you're spending on groceries, Personal Capital is a great Quicken alternative (but it'll also pull your credit card transactions so you will know how much you spent on groceries if you want!). Personal Capital is a full-featured, free, personal finance management tool that focuses on helping you with investing. It has a powerful mobile app (also means it's a cloud-based service) that replicates the web experience.

They're free because some users pay them for their wealth management services (optional). They are not stuffed with advertisements like some other free tools. You can read my.

Why it is a good alternative to Quicken: It's better than Quicken because it's updated, has a rich set of tools for investment and retirement, and it has a budget and expense tracking component. It's a website and not a software application, there's no software to download and patch or update (ugh) – that's all done automatically. I am a fan of their retirement planner, a tool that helps you project your future financial needs and whether you'll get there. It's worth checking out. One other vote of confidence for this Quicken replacement is their CEO – Bill Harris. He was formerly the CEO of Intuit and PayPal.

You know he has the leadership skills to dominate in this space and the ability to lead teams to build financial systems that are top notch (the rest of the leadership team is very impressive in their own right!). What could be better? The budget and expense tracking are good but it's not as old as Quicken, so it's not as developed as Quicken. I don't find it to be a negative because it works for me, but people with really complicated budgets may find it limiting. Here's a brief over view video of Personal Capital's cash flow and budgeting tools.

(since you access it with a browser, it is compatible with Mac OS!) 2. One of the most popular personal finance tools out there is a little software application known as Microsoft Excel. People love spreadsheets. You can customize it, tweak it, and get it tailored to exactly what you need.

The only downside to spreadsheets is how you need to pull the data yourself and who really wants to do that?  Quicken was great back in the day when there weren't nearly as many sync issues because it pulled the data for you. There's a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you'll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. () Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.

Quicken was great back in the day when there weren't nearly as many sync issues because it pulled the data for you. There's a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you'll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. () Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.

Popular Posts

If you\'re looking to replace, you\'re in the right place. For years, Quicken was the name in personal finance software. But let\'s accept reality – Quicken is often broken. It doesn\'t sync your accounts problem, you have password problems, screens that should appear are blank, and it\'s just not a great experience.

One of the biggest news items in the personal finance software space for 2015 was the releasing a new version of Quicken for Mac. The last time there was a true update for Quicken for Mac was in 2007. Quicken Essentials for Mac was released after that, but no one really takes that app seriously. (if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G.

Sometimes it feels like they\'re just getting you to buy the newer version, right? Quicken was once the most popular and powerful personal finance management software out there. But Quicken isn\'t what it used to be. It\'s hard to innovate a platform built in 1983. Back then, cell phones were bricks (if you could afford one) and apps were what you ordered at a restaurant. Quicken has faced a lot of technical issues and its support is meh at best.

(if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G. Look: If you\'re tired of Quicken, its support and sync issues, and want a suitable free alternative or replacement – we have some options. Here are some of the best Quicken alternatives available: Our Best Picks. If you\'re quitting Quicken and want to move to a spreadsheet you can customize to exactly what you need, Tiller will automate all the data collection for you.

You build a spreadsheet (or use a template) and Tiller will pull the data for you. Thus, saving you a ton of time and hassle. 11 Best Quicken Alternatives: • – free financial dashboard and wealth planner • – spreadsheet automation to bring it in house • – best in class budgeting tool & mindset • – ad-supported budgeting tool • – compare your situation with your peers • – can import data from Quicken • – not cloud-based • – follows Dave Ramsey\'s Baby Steps • – follows envelope budgeting method • – open-source and free • – date & calendar based budgeting 1. If you\'re a long time user of Quicken, you\'re beyond the “help me build my budget” phase. If you\'re more interested how your investment account is performing and less interested in just knowing how much you\'re spending on groceries, Personal Capital is a great Quicken alternative (but it\'ll also pull your credit card transactions so you will know how much you spent on groceries if you want!). Personal Capital is a full-featured, free, personal finance management tool that focuses on helping you with investing. It has a powerful mobile app (also means it\'s a cloud-based service) that replicates the web experience.

They\'re free because some users pay them for their wealth management services (optional). They are not stuffed with advertisements like some other free tools. You can read my.

Why it is a good alternative to Quicken: It\'s better than Quicken because it\'s updated, has a rich set of tools for investment and retirement, and it has a budget and expense tracking component. It\'s a website and not a software application, there\'s no software to download and patch or update (ugh) – that\'s all done automatically. I am a fan of their retirement planner, a tool that helps you project your future financial needs and whether you\'ll get there. It\'s worth checking out. One other vote of confidence for this Quicken replacement is their CEO – Bill Harris. He was formerly the CEO of Intuit and PayPal.

You know he has the leadership skills to dominate in this space and the ability to lead teams to build financial systems that are top notch (the rest of the leadership team is very impressive in their own right!). What could be better? The budget and expense tracking are good but it\'s not as old as Quicken, so it\'s not as developed as Quicken. I don\'t find it to be a negative because it works for me, but people with really complicated budgets may find it limiting. Here\'s a brief over view video of Personal Capital\'s cash flow and budgeting tools.

(since you access it with a browser, it is compatible with Mac OS!) 2. One of the most popular personal finance tools out there is a little software application known as Microsoft Excel. People love spreadsheets. You can customize it, tweak it, and get it tailored to exactly what you need.

The only downside to spreadsheets is how you need to pull the data yourself and who really wants to do that?  Quicken was great back in the day when there weren\'t nearly as many sync issues because it pulled the data for you. There\'s a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you\'ll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. () Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.

Quicken was great back in the day when there weren\'t nearly as many sync issues because it pulled the data for you. There\'s a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you\'ll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. () Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.

If you\'re looking to replace, you\'re in the right place. For years, Quicken was the name in personal finance software. But let\'s accept reality – Quicken is often broken. It doesn\'t sync your accounts problem, you have password problems, screens that should appear are blank, and it\'s just not a great experience.

One of the biggest news items in the personal finance software space for 2015 was the releasing a new version of Quicken for Mac. The last time there was a true update for Quicken for Mac was in 2007. Quicken Essentials for Mac was released after that, but no one really takes that app seriously. (if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G.

Sometimes it feels like they\'re just getting you to buy the newer version, right? Quicken was once the most popular and powerful personal finance management software out there. But Quicken isn\'t what it used to be. It\'s hard to innovate a platform built in 1983. Back then, cell phones were bricks (if you could afford one) and apps were what you ordered at a restaurant. Quicken has faced a lot of technical issues and its support is meh at best.

(if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G. Look: If you\'re tired of Quicken, its support and sync issues, and want a suitable free alternative or replacement – we have some options. Here are some of the best Quicken alternatives available: Our Best Picks. If you\'re quitting Quicken and want to move to a spreadsheet you can customize to exactly what you need, Tiller will automate all the data collection for you.

You build a spreadsheet (or use a template) and Tiller will pull the data for you. Thus, saving you a ton of time and hassle. 11 Best Quicken Alternatives: • – free financial dashboard and wealth planner • – spreadsheet automation to bring it in house • – best in class budgeting tool & mindset • – ad-supported budgeting tool • – compare your situation with your peers • – can import data from Quicken • – not cloud-based • – follows Dave Ramsey\'s Baby Steps • – follows envelope budgeting method • – open-source and free • – date & calendar based budgeting 1. If you\'re a long time user of Quicken, you\'re beyond the “help me build my budget” phase. If you\'re more interested how your investment account is performing and less interested in just knowing how much you\'re spending on groceries, Personal Capital is a great Quicken alternative (but it\'ll also pull your credit card transactions so you will know how much you spent on groceries if you want!). Personal Capital is a full-featured, free, personal finance management tool that focuses on helping you with investing. It has a powerful mobile app (also means it\'s a cloud-based service) that replicates the web experience.

They\'re free because some users pay them for their wealth management services (optional). They are not stuffed with advertisements like some other free tools. You can read my.

Why it is a good alternative to Quicken: It\'s better than Quicken because it\'s updated, has a rich set of tools for investment and retirement, and it has a budget and expense tracking component. It\'s a website and not a software application, there\'s no software to download and patch or update (ugh) – that\'s all done automatically. I am a fan of their retirement planner, a tool that helps you project your future financial needs and whether you\'ll get there. It\'s worth checking out. One other vote of confidence for this Quicken replacement is their CEO – Bill Harris. He was formerly the CEO of Intuit and PayPal.

You know he has the leadership skills to dominate in this space and the ability to lead teams to build financial systems that are top notch (the rest of the leadership team is very impressive in their own right!). What could be better? The budget and expense tracking are good but it\'s not as old as Quicken, so it\'s not as developed as Quicken. I don\'t find it to be a negative because it works for me, but people with really complicated budgets may find it limiting. Here\'s a brief over view video of Personal Capital\'s cash flow and budgeting tools.

(since you access it with a browser, it is compatible with Mac OS!) 2. One of the most popular personal finance tools out there is a little software application known as Microsoft Excel. People love spreadsheets. You can customize it, tweak it, and get it tailored to exactly what you need.

The only downside to spreadsheets is how you need to pull the data yourself and who really wants to do that?  Quicken was great back in the day when there weren\'t nearly as many sync issues because it pulled the data for you. There\'s a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you\'ll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. () Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.

Quicken was great back in the day when there weren\'t nearly as many sync issues because it pulled the data for you. There\'s a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you\'ll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. () Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.